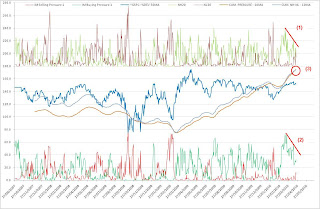

Historic EXHAUSTION Analysis of the GERMAN DAX INDEX from 1990-today:

We thought this week it would be helpful to provide some historical context behind the concept of Exhaustion. There are 1001 definitions of Exhaustion and each analyst is using his own secret recipe, but in the end all measures relate to some kind of measurement of Extremes.

The reason why I show you the 20 years of analysis is because it shows very graphically what exhaustion concepts can provide and what they CAN NOT. (A picture says more then a 1000 words!!)

The quality of Exhaustion Signals is fairly reliable with a slight tendency to be to early at HIGHs (which results from the fact that the LOWS are usually short term events/datapoints, like "MAR9, 2009-THE LOW", whereby HIGHs are more protracted processes).

BUT.....Exhaustion Signals have one significant shortfall, they don't work in parabolic/bubbly markets which are characterized by the notion that they simply move on against the backdrop of Exhaustion and ignore OVERBOUGHT & EXTREME readings.

WHAT DOES IT MEAN?

- We are either entereing a new BULL and will ignore the EXHAUSTION or

- We will see some serious downside action or at least some reasonable pause

- The next couple of weeks will tell you in which scenario we are by either accepting or ignoring the EXHAUSTION