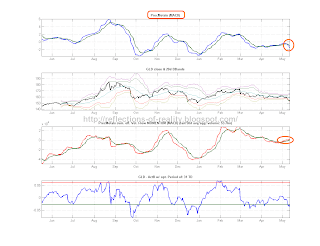

Here at 'Reflections' we always look for extremes & skews in the Market. WE came across Morgan Stanley where the 'short condor' options strategy (long call spread & long put spread) seems to indicate that we have reached some kind of extreme, where the market is pricing in some nearterm spike in volatility in MS. 'Vola has no face' so we don't know the direction yet.

When we compare this with the last 3x times we get some idea that this could evolve into something tradeable.

MS does NOT happen in a vacuum at times of perfect correlations, so if MS moves so will the Market....

When we compare this with the last 3x times we get some idea that this could evolve into something tradeable.

MS does NOT happen in a vacuum at times of perfect correlations, so if MS moves so will the Market....