Gold has the flameout in progress with still extreme values in all gages. Gold might have a retest in the works but we saw similar ones with Silver earlier in the year.

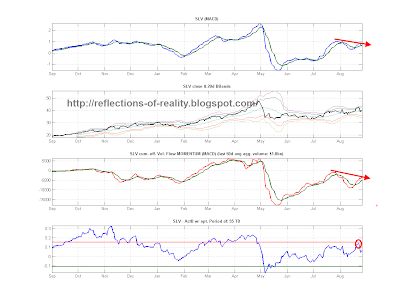

Silver actually once it entered into the flame-out in mayhad to tumble as long as all the excesses were out of the Optionflows (bottom left chart). Compare this with Gold above and you get the picture what could expect Gold and for the same token the USD long Bond and the SWISSIE...

MOMO still has way to go on the downside....

...and the timing model seems to paint a more negative picture too.

CONCLUSION:

It aint't over until it is over !!

The bounce now has shaped up in a symmetrically fashion with 2 x 71point rallies that carried the bounce right to the 38% Fibo level of the initial impulse down and also back up to the MAY 2011 High (see ROADMAP).

The bounce now has shaped up in a symmetrically fashion with 2 x 71point rallies that carried the bounce right to the 38% Fibo level of the initial impulse down and also back up to the MAY 2011 High (see ROADMAP).

Last week make me remember what I read from Benoit Mandelbrot that "time runs faster in Volatility compressions". I re-did one of my earlier analysis from 2008 when I used his concept to show that something had changed in the structure of the market.

Last week make me remember what I read from Benoit Mandelbrot that "time runs faster in Volatility compressions". I re-did one of my earlier analysis from 2008 when I used his concept to show that something had changed in the structure of the market.