Saturday, December 24, 2011

Yearend Post

We expect Santa to stay on for a couple of more days.

Gold should jive nicely with our Bradley outlook....although the picture looks slightly different in Euros.

The Small Caps had their yearend seasonal out-performance.

Silver will follow the risk trade.

The Euro is poised for some bounce in Q1.

Gold gets in position....

The Small Caps are getting rich....

The Skews seems to support the above.....

Gold is getting in position....

Small Caps might have some air left ....

The above fits also into the picture where our VIX_OSC is getting Overbought and seems readyfor some Jan. bear action....

Merry X-Mas and a Happy New Year!!

Friday, December 23, 2011

Do you believe in the Stars - Bradley Edition

Being open to all sides is one of the most difficult things to do in a time of Info overload and plenty of 'EXPERTS' that seem to know better. One of the Gurus I like to listen to is Larry Peasvento, a Legend on his own. Larry is big into Astrology and one of the most famous models is the BRADLEY MODEL (see below or google yourself). Besides the fact that there are 10 good reasons to look the other way, the success ratio seems to defy plain chance or coincidence. So not knowing what makes it work we looked at the recent track record and more interesting we looked at the 2012 outlook.

The 2012 model predicts a very bullish blow off into the spring, followed by a massive sell down that will follow through all the way to the end of the year.

(Donald A. Bradley documented his research in 1948, "Stock Market Prediction -- The Planetary Barometer and How to Use It," on mass psychology and its impact on the U.S. stock market. His booklet, long since out of print, revealed his findings and exact computation methods underlying his discovery. Bradley's work illuminates the elusive powerful natural forces affecting men's minds and emotions behind the broad cycles in world economic and political trends sometimes with pinpoint accuracy. Bradley concluded that some 190 planetary aspects are the secret engine behind the cycles in mass psychology frequently occurring in the stock market.)

Option Skews: Methodology

It's time to bring sth. new to the selected group of 'REFLECTIONISTAS' a.k.a my readers.

This time around we will look at optionskews and their symmetries. Below you will find de-trended Option premium term curves for puts and calls. We usually pick a strike that is close ITM-in the money- (proxy for ATM) and compare the option premiums along the future expirations. We do the same for Puts and Calls. In a perfect , read theoretically efficient market the Vola (and thus the premia) should look alike for puts and calls. Only if some big players bets one side in size will we see differences in premias. For visual reasons we decided to adjust & de-trend the data in order to highlight these speculative positions. Sometimes the differences are bigger than others => read stronger signals.

Dependent on the usage of the underlying as a direct speculation vehicle or as a simple hedging tool the 'Call'-bias (green line on top of the red line) has to be interpreted as bullish (spec. vehicle) or as bearish (hedging vehicle).

Below you find the analysis for the SPYDER which has clearly been a hedging vehicle and thus lets us interpret 'Put'-biases as bullish (and vice versa).

Each term curve is a snapshot of a certain pivot point in the market that relates to the pivotchart at the end (be guided by the numbers).

As of Dec. 19 we don't see any strong conviction towards a Santa rally and therefore will treat Santa with caution.

Wednesday, December 21, 2011

Sentiment sets up for bearish shake out

There haven't been that many instances in 20 yrs where the VIX_OSC has reached this extreme level and had had not followed through with a tradeable correction. Maybe the market will carry this over into the new year but then the excess of the indicator should be even worse.

Santa has a week left bring us gifts....

Sunday, December 18, 2011

Weekly TimeCycles & OptionFlows highlights: Where has Santa gone ?

Silver is Oversold but still needs more time to heal.

Nonetheless Gold needs still some more time to heal.

Silver might be along a bit further down the road.

Small Caps seem to skip the Santa rally....

...same as the Spyder

FlowMomo confirms that view.

..as do the OptionFlows for HOT MONEY...

Small Caps

and SPYDER.

The Dollar goes into the same direction hinting at more EURO WEAKNESS = RISK OFF = Dollar Strengthg for the immediate future....

...with arisk to evolve into a 1995 kind of scenario which could be morph into something even worse.

Bottom line:

- watch the Dollar, maybe it can take a brief break and allow Santa to return for 2+ weeks. If not, i.e. folks try to lock in year-end P&L's then things could turn painful.

- Precious Metals look promising after the liquidations of the last 2 weeks.

Thursday, December 15, 2011

Interim Low in Gold and Stocks ?

The Liquidity Index gives no clear guidance. 2 Cases seem possible.

The Gold Breadth chart indicates a potential interim LOW in Gold might be close. This can be seen by the extent of the fall of the Liq. Index and by the length of the timing window.

The Vix_Osc is still overbought and needs some more pressure relief.

Sunday, December 4, 2011

Weekly TimeCycles & OptionFlows highlights: SANTA has arrived

SUMMARY:

- Santa has arrived

- Santa could run into 01/2012

- ...but he brings less gifts as in the past, thus we expect some Santa breather in december

Gold and the Prec. Metals looks good for the next 2 weeks and also medium term.

Hot Money has played Santa fairly well so far is taking off some risk trades shortly before their bonuses will be determined (year end). Better to have realised gains than unrealised ones.

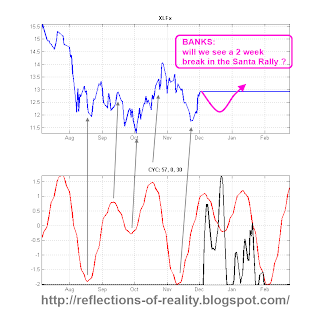

Spyder and BANKS timing:

The QQQ's ask exactly the right question at this stage: Is this just a quicky....or are the good times back ?

APPLE:

BANKS:

SMALL CAPS show no conviction:

SPYDER:

20 yr Treasury will give us more guidance soon:

OIL seems to tag along with the SANTA theme:

There will be no posts next weekend due to other commitments.

Friday, December 2, 2011

Market is exploding upwards with deteriorating Liquidity

The Liquidity picture of 2011 is now officially worse than it EVER was.

(We measure liquidity by simply counting the 90% breadth days in the S&P500 in a certain time window. When the market has only buyers and no sellers or vice versa then the market is illiquid)

The VIX_OSC seems rich already which comes from the 'too much, too fast' syndrome which is NORMAL in illiquid markets.

Indicator 2 has already flipped.

We knew that sth exceptional was in the making last week and so it happened.

Subscribe to:

Posts (Atom)