More upside seems plausible, but a tumble from here as well...

More upside seems plausible, but a tumble from here as well...

Thursday, March 31, 2011

Wednesday, March 30, 2011

TimeCycles: Are we there yet ?

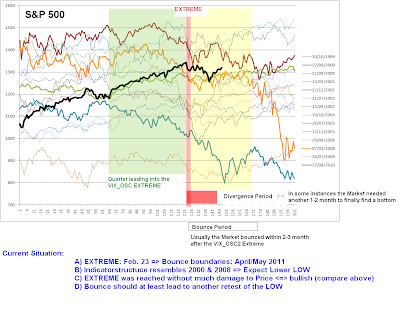

Sentiment RHYMES

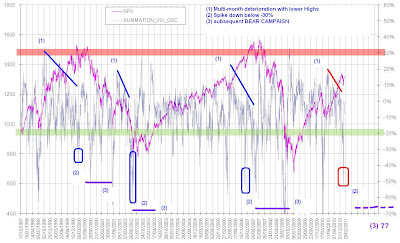

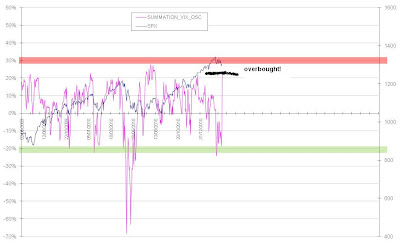

Golden5: Sentiment within a historical context or why we would take it easy on the long side...

Golden5: Sentiment still looks bearish

Sunday, March 20, 2011

OptionFlows

Saturday, March 19, 2011

Tuesday, March 15, 2011

Golden5: Sentiment reached a temporary Bounce level...

Saturday, March 12, 2011

OptionFlows

As you can see we added the TimeCycles to our OptionFlow analysis. We see a bear in the SPYDER and Tech and a breathing bull in Gold&Silver. This all sets the Context for the earlier post on TimeCyles and MOMO.

MOMO update

TimeCycles (Beta)

Our new TimeCycles tool projects a A-B-C correction in Gold that can run into late April.

Oil seems to have more upwards work to be left for the remainder of the month...

Oil seems to have more upwards work to be left for the remainder of the month... The SPYDER and the Tech Q's are cleary portraying a bearish picture in the end of March.

The SPYDER and the Tech Q's are cleary portraying a bearish picture in the end of March.

TimeCycles:

We screen with a Monte Carlo algo the Timeseries and try to find relevant cycles that were valid the last 2 full cycles. In a final step we aggregate all significant cycles.

Friday, March 11, 2011

Golden5: Sentiment at a crossroads

Monday, March 7, 2011

construction work....

We are in the process of adding a TimeCycle tool to our model and thus will not find the time to post this week.

In my absence enjoy the ride in Gold (above 1440) and Silver (above 36) .....

Also bear in mind that this week will be the 9th Tom DeMark Sequential weekcount in the EURO which only needs (at least an open above last week's close: already done) a negative week on closing basis (+ subsequent confirmation) to trigger a potential SELL signal .....

Saturday, March 5, 2011

Subscribe to:

Posts (Atom)