the next leg up could be explosive, given where MoneyFlows are...

the next leg up could be explosive, given where MoneyFlows are... Ouch, the Banks look bad.

Ouch, the Banks look bad. Bottom line:

Bottom line: Follow MOMO and Flows first and look for confirmation in the Sentiment. Thus expect more consolidation.

Against the backdrop of the Exhaustion Watch and the MOMO & FLOW picture and the broad Sentiment , but also taking into account a more mixed micro Sentiment look, I would broadly think that the correction has started, experienced some countermove in the OPEX ( ...remember this used to be Hank Paulson's speciality given that they needed good weather for GM!!!) and still has nor finished yet.

Against the backdrop of the Exhaustion Watch and the MOMO & FLOW picture and the broad Sentiment , but also taking into account a more mixed micro Sentiment look, I would broadly think that the correction has started, experienced some countermove in the OPEX ( ...remember this used to be Hank Paulson's speciality given that they needed good weather for GM!!!) and still has nor finished yet. ...and the Banks look worse.

...and the Banks look worse. Prec. Metals on the other hand look like they are gettin' ready for rock'n'roll. The Flows look like they want to explode and the still OVERBOUGHT MOMO needs only another brief respite to trigger the move....

Prec. Metals on the other hand look like they are gettin' ready for rock'n'roll. The Flows look like they want to explode and the still OVERBOUGHT MOMO needs only another brief respite to trigger the move.... Bear in mind that in the world of THE GOLDEN5 Rules MOMO, FLOW MOMO come before Sentiment. This means that we always have to interpret SENTIMENT in the context of the then existing MOMO & MOMO FLOW picture.

Bear in mind that in the world of THE GOLDEN5 Rules MOMO, FLOW MOMO come before Sentiment. This means that we always have to interpret SENTIMENT in the context of the then existing MOMO & MOMO FLOW picture. The Prec. Metals have also lost some of the exuberance but still seem tohave a week or so to go..

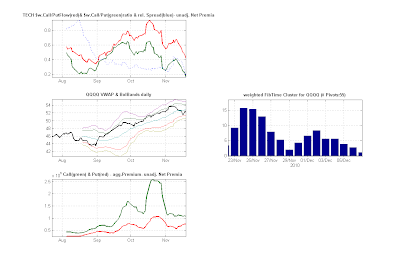

The Prec. Metals have also lost some of the exuberance but still seem tohave a week or so to go.. The Banks on the other side look bearish and the Call/Put ratio looks still overbought. Let's monitor next week.

The Banks on the other side look bearish and the Call/Put ratio looks still overbought. Let's monitor next week. Tech looks bullish ! The CallÜut has nicely reached a level from where it took of in September.

Tech looks bullish ! The CallÜut has nicely reached a level from where it took of in September.

Look at Gold, Silver, Miners: Interestingly Price was moving much more aggressively then Money Flow, meaning the amount of high octane speculators that bought into prec. metal after a $200 run (Gold) was limited. Let's see how far the correction goes.

Look at Gold, Silver, Miners: Interestingly Price was moving much more aggressively then Money Flow, meaning the amount of high octane speculators that bought into prec. metal after a $200 run (Gold) was limited. Let's see how far the correction goes.

We marked the test area in yellow.

We marked the test area in yellow.

Compare the VOL FLOW analysis with the Prec. Metals Flows (GLD, SLV, GDX).

Compare the VOL FLOW analysis with the Prec. Metals Flows (GLD, SLV, GDX). 2 conclusions:

2 conclusions: