Forget any downgrades of Spain, everybody is betting on Super Mario and Heli Ben. So even the Euro catches a bid...

...like AAPL brought life back in the Q's.....and OIL likes May.....

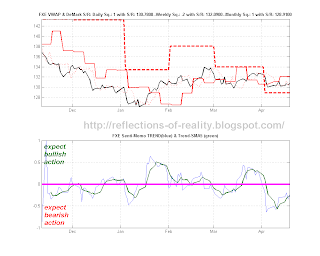

...but something has to give...Sorry VIX

...will the leading Materials warn us of a 'FLASH in the PAN' ?

The DXY and the Euro are in sync for MAY.

...as are the small caps.

Look at Dr. Copper who likes to do some seasonal play of his own around May which aligns with our TimeCycles model.