More Vola will come our way in Materials...

...the Euro...

...whereby the Vola could be of the benign kind in a bullish way, now that many Asset classes have re-entered or defended the Bull..

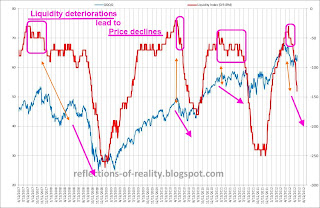

....the final timing on the bullish campaign (we still call it just a BOUNCE) seems uncertain, but a couple of weeks or even 1-2 months are in the cards.Remember our early Canary who alerted us of the coming tidal shift?

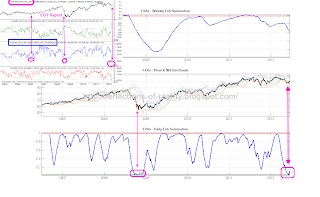

When we look at the leveraged Bulls the picture looks similar...

Update on OIL:......but there is also a chance that the Bounce gets cut short which we don't view as our base case as of know.

We promised you a volatile week with an upside bias last week and what a week we got !

The next phase should be continuation of this in the end of July +/-.

(This will be out last post before our summer break. We will return in Ausgust. Enjoy the Summer!!)