Wednesday, February 27, 2013

Monday, February 25, 2013

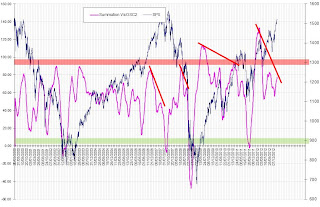

The key VixOsc is entering the Bear Zone

....and did you see what happend to the EURO.....1.3054, that's what we call an impulsive move below the 1.3150 that will activate the 1.26-1.20 target as shown over the weekend.

Saturday, February 23, 2013

A new chapter to our 'Rolling Top theme'

The market character seems to have changed las week. Our Market model went short on Thursday, but doesn't seem completely convinced yet.

Anomalies where you look. Take for example our next chart, that has not accounted for a single OptionFlowExtreme in nearly a year which in itsself is an extreme.

Why we see more downside risk for the EURO

Our TREND model which is an aggregation of a host of MOMO, FLOW and Option Indicators has a fairly good track record and call for more downside.

The Euxhaustion gage we use (also a incredient into our secret TREND 'sauce') has a 7 out of 7 bet out against the EURO. Thus we espect a correction that will fullfill time and / or price objectives before we can change the outlook.

MOM(O)entum is speaking a similar language. We see a short-term streched move with plenty of downside potential in the medium-term.

The Euro has played a pivotal role in the global Risk Trade , so an adverse fate will also bode ill for the rest of the trade.....

Is this the final exhaustion in Gold we need for the next leg up ?

Sentiment and the weekly technical assessment call for a medium term low in the making. Therefore we should expect a low within 0-2month.

Pls also observe the Love-Hate realtionship Gold has with the Equity market where it likes to tag along for the bull leg in equities and then (as 'safehaven') during the correction Gold tends to run alone.

The Cycle chart actually confirms the technical findings. We could see a monthlong rally followed by another test of the bottom before we really continue flying again.

The next charts gives further evidence that the Gold market is OVERSOLD and should rally soon. But be careful, 'rally soon' would also allow for another exhaustive move to the downside before the rally!

Bottom line:

- long & medium term bullish

- ...waiting for short term confirmation that the bottom is in

Friday, February 22, 2013

Saturday, February 16, 2013

Friday, February 15, 2013

Quick Thoughts for this weekend

1) Gold is bottoming in Dollars and in Euros

2) The Rolling Top in the risk Trade is continuing, with the Dollar already strengthening. The EURUSD could NOT hold 1.35 which we wondered last week

Don't get blinded by the Noise !

Sunday, February 10, 2013

Saturday, February 9, 2013

Top in progress

The model is still cautious...

...the correlation and Risk-Reward-Multiple strategy (long Vola strategy) is crying wolf.......the small caps see a bearish kick off like the EURO

...and Seniment is overbought.

Watch the FX markets for clues on the Risk trade

The EURUSD dropped back below a key Fib-Level and could target the next downside zone.

The Weekly EURYEN paints a similar picture. The Bull move stopped at a resistance level and should we see downside confirmation the action could get explosive.

If the Euro can NOT be pushed up again (by the global Centralbanks) then a stronger Dollar and Yen does bode ill for the Risk Trade bulls for the next months.

Monday, February 4, 2013

Sunday, February 3, 2013

JO-JO in Gold this week means what?

The TREND indicator dived because of a flip in the EXHAUSTION Indicator.....

... EXHAUSTION look bearish short term but within a ver bullish medium term context.......that is already shaping up in the MOMO picture....

Similar to our AAPL OSC we also looked into a Silver-Gold OSC that at this stage confirms the bullish undertones.

Conclusion:

We are in a bottoming process !

Saturday, February 2, 2013

Subscribe to:

Posts (Atom)