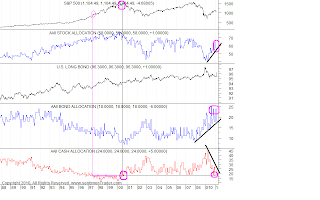

Our SUSI is taking a stance here! She seems to have a hunch, let's see how it works out.

Our SUSI is taking a stance here! She seems to have a hunch, let's see how it works out.Clearly the Market needs a break or pause. The action of the last 2 trading days where we saw profit taking late in the day are indications of that.

Every technical tool in the box is overbought, it feels like that this rally will never end, the bears have all changed sides and allthough there isn't anybody that questions the weird character of the market nobody dares to openly act against this fairytale.

I think ElliottWave's Bob Prechter once said that the market has a perverse streak to always act in a way that causes the most harm to most of the people.

A deflationary setting with falling commodities (maybe with stable Gold) and falling Asset Markets would exactly accomplish that in the current market.

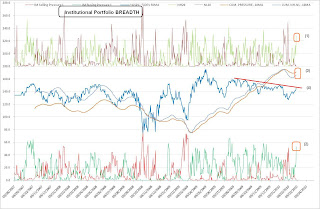

This constitutes the RISK CASE because nobody believes in it and being the cynic I'm I believe there is chance for this to happen!! All these negative Divergences function like rubberbands where either the band breaks (bullish case) or the rubberband flashes back (bearish case). The Divergences tell us that the energy cummulates meaning the reaction (bull or bear case) will be a function from the initially saved energy.

This means in plain english that with each day passing by without a healthy correction the risk for a BIG MOVE rises.

Exactly when all feel save the risk is the highest....(This is also the reason why we monitor all kinds of exhaustion indicators to measure the energy level.)

A quick fall through 1050 on the S&P500 and we have a failed breakout which could turn nasty.