The 2 key safehavens are Gold and the Long Treasury Bond (TLT).

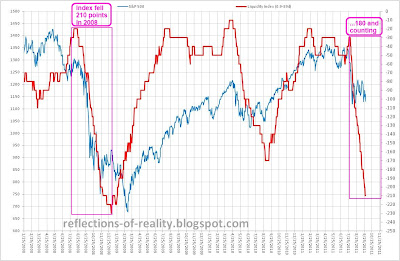

TLT's optionflows paint a mixed picture within a severely overbought market for the TLT.

The Exhaustion chart shows a neg. Div in a highly oversold market which normally should halt, pause or correct the move to some extent.

On the Gold side, I'd like to bring your attention to the GDX (Goldminers) that have broken out this week with the risk of painting a fake break out move given the extreme Optionflows!

If the miners fail then Gold should feel the affect.....

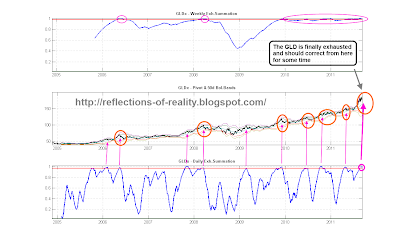

The Timing chart point into the same direction

The Gold Optionflows still need to be interpreted in a bearish way.

The Exhaustion picture needs no comments.