Key theme of the week:We had 3 days back to back where the market popped up all the way through a major resistance field and got sold down towards the end of each day.

If we'd held above the resistance area the Market could have targeted 1200 (S&P500) or 120 (SPY ETF). The fact that it didn't happen is a strong message.

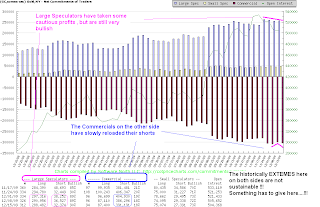

Even stronger though was the fact that run #3 was supported by "DREAM ECONOMIC DATA", reminding me that bull campaigns always end on good news and that the WALL of WORRY has now been torn down, now that we KNOW based on the employment data that the turn around has been accomplished !!In terms of contrarian thinking this is Nirvana. You have 3 failed break outs with Volume and the last one on good news right around the 50% Retracement level (TIME & Price ,

pls see here) of the entire 2007-2009 crash.

- Gold got hammered

- the US$ had a great turn on Friday

- Banks still look like a bear flag that has never confirmed the S&P500 new highs of the last swing

- Small Cap look like the Banks

Bottom line:

Next week should be very interesting. If we see a run#4 that succeeds then expect a quick melt-up towards 1200 (SANTA rally 2009). The current picture looks like we just had our SANTA rally and that we could see some downside action into Jan-Mar 2010.

GLD/ GOLD

GLD/ GOLD