Saturday, December 25, 2010

Exhaustion & Hedgefund Watch

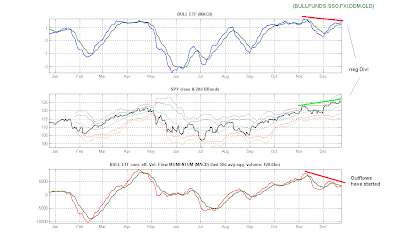

The Hedgies have started to tip their toes into the bear waters...

...while taking some profits off the table...

Our Exhaustion Watch reiterates that we are...

Oversold and tired after the promised SANTA rally... we promised you....

Friday, December 24, 2010

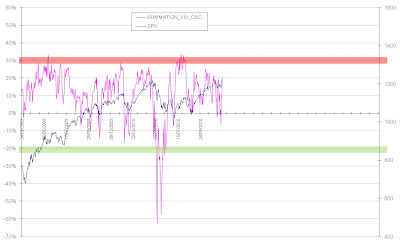

Golden5: Breadth is nicely topping

Golden5: Sentiment EXTREMES

Sunday, December 12, 2010

The platinum trade.

Following ISE extreme Signal (see current extreme here) has been one of the best trades since 2005.

Above we show what have been the optimal Return on Investments had you been followed the ISE Extremes exceeding a Threshold of 0.1 (note the current one is 0.29). On the bull side you had safe bets earning 10%-20% whereby the bearside was more volatile with trades earning 7%-25% within the next 40 trading days.

(NO bad trades in 4 years!! <=> Bears ahoi!!)

I leave you here for the next weeks and wish you a merry x-Mas!!

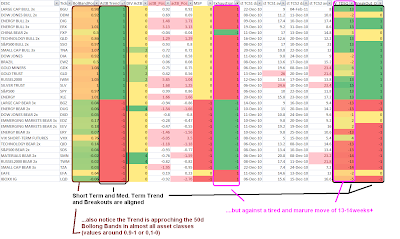

MOMO, VOLUME, Sentiment review by Sector

Tech is showing a neg Div in the sentiment gage and hints at a rally that could run into year end.

Tech MoneyFlow looks bad and MOMO has also developped a neg Div!.

Tech MoneyFlow looks bad and MOMO has also developped a neg Div!. Banks approach exuberance in Sentiment land and a FibCluster around X-Mas. See also that there is no put flows anymore = bears are given up...

Banks approach exuberance in Sentiment land and a FibCluster around X-Mas. See also that there is no put flows anymore = bears are given up... Momo & Money Flow are OVERBOUGHT.

Momo & Money Flow are OVERBOUGHT. Our key Institutional Hlgds portfolio shows neg Divs as far as the eye can see and an X-MAS FibCluster.

Our key Institutional Hlgds portfolio shows neg Divs as far as the eye can see and an X-MAS FibCluster.

Prec. Metals seem to need more time to correct.

Prec. Metals seem to need more time to correct. neg Divs!!

neg Divs!!

Saturday, December 11, 2010

Golden5: Breadth

Friday, December 10, 2010

Sentiment is in HIGH RISK Land!!

Saturday, December 4, 2010

MOMO & FLOWS & SENTIMENT

Exhaustion Watch: the correction that doesn't want to happen...!

Golden5: Breadth update

Friday, December 3, 2010

Sentiment update: The Rubber band is stretching

Our VIX_OSC Indicators show a Topping Process with a more complex negative Divergence....

ISE look like a topping Process!!

CBOT also does not look like a bottom !

CBOT also does not look like a bottom !

Bad employment data, weak Dollar and strong Equity Markets indicate a purely technical Market.

It all looks like a looming explosion to the downside or upside....

Wednesday, December 1, 2010

Subscribe to:

Posts (Atom)