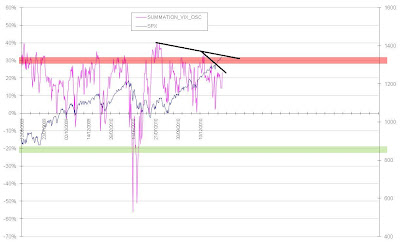

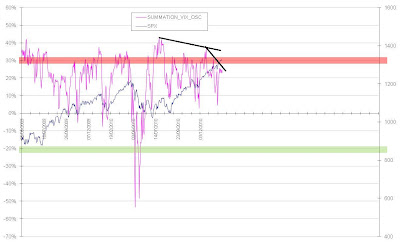

Inst. Porfolio could bounce early next week into the 1st of March but still has some work on the downside to be done.

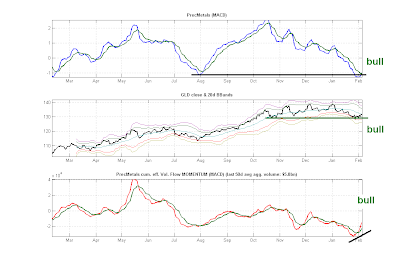

Can the PrecMetal develop divergences ?

Can the PrecMetal develop divergences ? Banks are extended.

Banks are extended. Oil could be exhausted here ...OR...develop divergences while shooting higher.

Oil could be exhausted here ...OR...develop divergences while shooting higher.