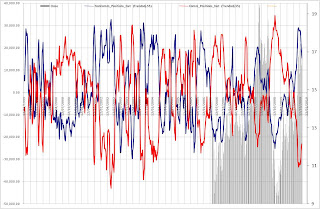

GC: GOLD, SI: SILVER, DX: DOLLAR, CL:CRUDE OIL

- Commodities: GC, SI, CL show extreme Short Positions for the Commercial Traders which usually lead the Market and which are strongly affected by some large Banks that act as counterparts to most commodities ETFs and Hedgefunds (key banks like a JPMORGAN, etc.)

- GC & SI seems very fragile given the extreme move on the price side and the continued extreme short position: something has to give here fairly soon.....

- DX seems more dominated outright by the non-commercial traders a.k.a. "large speculators" where we can observe some short covering (although the net position -blue line- is still net short). It could be the beginning of a trend but the move needs more confirmation to call that.

No comments:

Post a Comment