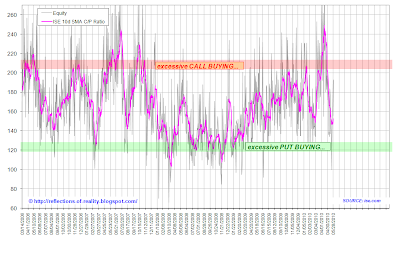

- Both Option Exchanges show similar Equity Options Put/Call Ratios

- Both come from a historical degree of "EXUBERATION"

If you believe we are in a cyclical bull......then you will interpret the P/C data as OVERSOLD and BULLISH

If you believe we are in a cyclical bear......then you will interpret the P/C data as NEUTRAL and BEARISH

If you have an open mind, then you want to see a level of "excessive put buying" as confirmation for the bear or a bounce back towards "excessive call buying" to confirm the bull!!

No comments:

Post a Comment