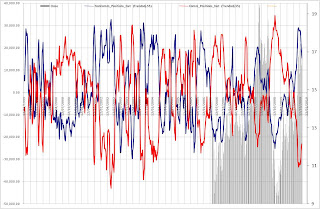

Gold seems to be in solid uptrend, supported by good institutional money inflows. The trend could even sustain a certain degree of a correction without being put in question.

Looks like we are in for some consolidation. The TCS (TimeCycleSpikes) hint at mid to late December and January. Key will be whether the correction can develop some momentum to the downside or whether "the printing FORCE" can regain control.

The Market here has a fair chance to put in a top of the bear market rally from March. This only means the the probabilty is relative high but far from certain!

Debt:

United Arab Emirates (via Bank of America - Amortization figures only):

Total Debt: $184 billion

of which...Dubai: $88 billion

Abu Dhabi: $90 billion

Dubai:

Due in:

2010: $12.0 billion

2011: $19.0 billion

2012: $18.0 billion

2013: $ 7.5 billion

2014: $ 5.5 billion

Abu Dhabi:

Due in:

2010: $ 8.5 billion

2011: $14.7 billion

2012: $10.0 billion

2013: $12.4 billion

2014: $ 9.4 billion

UAE:

Due in:2010: $22.0 billion

2011: $34.7 billion

2012: $29.0 billion

2013: $20.3 billion

2014: $14.9 billion

Dubai World:Total Debt $26.5 billion

Due in next 36 months: ~$20.4 billion

Creditors:

Of United Arab Emirates (By Origin via Credit Suisse citing Bank for International Settlements):

United Kingdom: $50.2 billion

France: $11.3 billion

Germany: $10.6 billion

United States: $10.6 billion

Japan: $ 9.0 billion

Switzerland: $ 4.6 billion

Netherlands: $ 4.5 billion

Of United Arab Emirates (By Entity via Credit Suisse, citing Emirates Bank Association):

HSBC Bank Middle East Limited: $17.0 billion

Standard Chartered Bank: $ 7.8 billion

Barlays Bank Plc: $ 3.6 billion

ABN-Amro (RBS): $ 2.1 billion

Arab Bank Plc: $ 2.1 billion

Citibank: $ 1.9 billion

Bank of Baroda: $ 1.8 billion

Bank Saderat Iran: $ 1.7 billion

BNP Parabas: $ 1.7 billion

Lloyds: $ 1.6 billion

Other notes of note:

"Gold Sentiment

Finally I wanted to add a tiny nugget to the exhaustive sentiment analysis of gold I wrote at the start of the week: the Daily Sentiment Index for gold has now spent more than 17 consecutive days above 90%.

A feat it only narrowly beat in 5 years ago when it spent 20 consecutive days, from early November to early December 2004, above 90%. It managed to create a top at $457 that lasted almost 10 months. And to think, back then it was only 12% above its long term moving average while now it is 23%."

Conclusion:

The next weeks will decide on the battle of money printing vs. deleveraging. Anything can happen here!! The overall structure is very fragile. A black swan could emerge but doesn't have to...

GC: GOLD, SI: SILVER, DX: DOLLAR, CL:CRUDE OIL

Could Gold and Silver develop a Headfake ?

Pls see also this post from the ETF CORNER and our GLD flow post from yesterday